International trade and finance theory seems to have been one of the major sacrifice of the Eurozone crisis, together with the future prosperity of the citizens in the small, peripheral net importing countries.

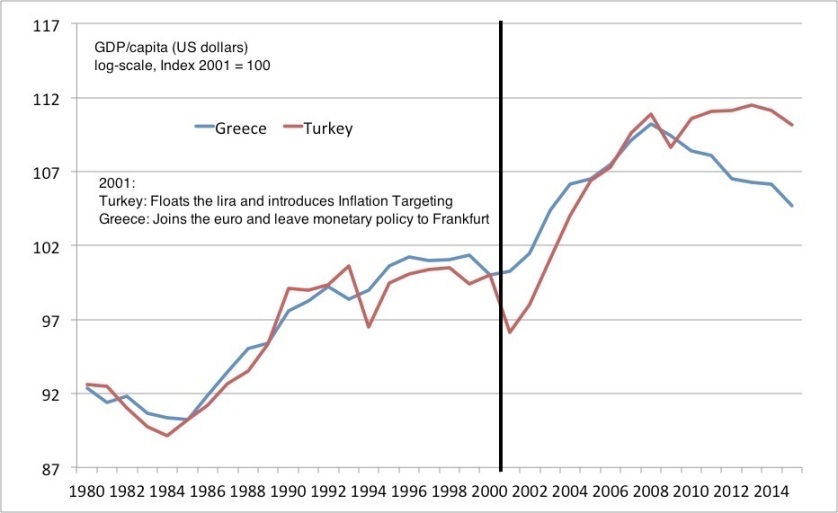

Now, a Danish economist reminds us of the principles of International Economics 201 with an article entitled, "Greece versus Turkey: It's the exchange rate regime, stupid".

Coming from Denmark, the smart little country that voted to stay out of the Euro, this deserves a good rereading by all those lawyers maskerating as finance officials. The threat of devaluation raises financing costs for an economy over the short term, a small price to pay to avoid financial disaster affecting several generations.

The persistent mantra of "exiting the bailout conditions and returning to the financial markets" which we hear from the politicians and the financial media in Portugal doesn't even begin to touch on the underlying causes and consequences of the persistent balance of payments crises.

The persistent mantra of "exiting the bailout conditions and returning to the financial markets" which we hear from the politicians and the financial media in Portugal doesn't even begin to touch on the underlying causes and consequences of the persistent balance of payments crises.

Mariana Abrantes de Sousa

PPP Lusofonia

Greece versus Turkey: It’s the exchange rate exchange rate regime stupid!

Now, a Danish economist reminds us of the principles of International Economics 201 with an article entitled, "Greece versus Turkey: It's the exchange rate regime, stupid".

Coming from Denmark, the smart little country that voted to stay out of the Euro, this deserves a good rereading by all those lawyers maskerating as finance officials. The threat of devaluation raises financing costs for an economy over the short term, a small price to pay to avoid financial disaster affecting several generations.

The persistent mantra of "exiting the bailout conditions and returning to the financial markets" which we hear from the politicians and the financial media in Portugal doesn't even begin to touch on the underlying causes and consequences of the persistent balance of payments crises.

The persistent mantra of "exiting the bailout conditions and returning to the financial markets" which we hear from the politicians and the financial media in Portugal doesn't even begin to touch on the underlying causes and consequences of the persistent balance of payments crises. Mariana Abrantes de Sousa

PPP Lusofonia

Greece versus Turkey: It’s the exchange rate exchange rate regime stupid!

Sem comentários:

Enviar um comentário